Housing sales have soared in Texas, and some may wonder how it compares other real estate booms and bubbles of the past, including the one in California more than a decade ago that led to the 2008 financial crisis.

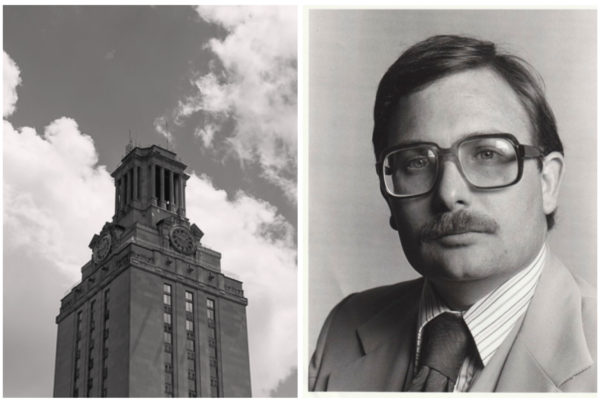

Luis Torres, a research economist at Texas A&M University’s Texas Real Estate Research Center, told Texas Standard there are a few distinctions between the current Texas boom and what happened in California in the mid-2000s.

First of all, mortgage lenders’ practices were unique during the California real estate bubble, and they significantly contributed to the credit crisis that destabilized the financial system.

“The joke at that time was that anybody that wanted to get a mortgage and apply for it would get that mortgage,” Torres said. “A lot of people that shouldn’t have gotten a mortgage got financing to purchase a home.”

Then, of course, he says there was weak oversight of those lenders.

RELATED: Texas’ Real Estate Market Is Bonkers For The Agents, Too

Since then, lending practices have been changed and laws have been instituted.

So Torres says the main thing that is similar between now and then is the “frenzy” over homebuying.

“Let’s call it the ‘pandemic frenzy’ now,” he said, “where you feel you’re going to be priced out of the housing market. You’re scared, you’re like, ‘Oh, my God, I want to buy a house. If I don’t buy it right now, and I’m seeing prices increases at a high rate’ – you feel you’re going to be priced out, right?”

He says homeowners have benefited the most from this pandemic frenzy, as well as those who have jobs in industries in which they can work remotely. For those who had the means, they were able to improve their work-from-home spaces by finding a home with more space, or living in a more desirable location, or having a bigger yard. Torres says the people who were able to act on their desire to improve their living space had job security during the pandemic; some even prospered over the last year and a half.

But he says what’s happening in Texas isn’t a housing “bubble,” so it won’t burst. However, there will be a slowdown. Torres expects interest rates on mortgages to rise, which should weaken some of the demand. He also says more homes are coming onto the market, which could also help ease demand and drive down prices.

What likely won’t change are higher housing prices than before the pandemic. Texas has become a desirable state for many people to live in; Torres says prices only usually drop in places where people don’t want to live.

“Think about cities like Detroit where people moved away because the automotive industry was not doing that well; there was a big shift in that industry,” he said. “But that’s not happening in Texas; Texas’ economy is booming. We expect the Texas economy to continue to boom in the coming years. So, those prices are here to stay.”