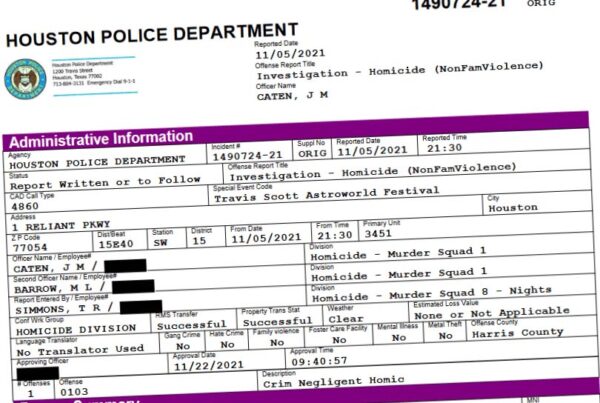

After the Supreme Court struck down President Joe Biden’s plan to eliminate $400 billion in student loan debt, the Biden administration announced earlier this month that more than 800,000 borrowers will have their student loans – about $39 billion in debt – wiped away through the SAVE Plan. Among those borrowers are 64,000 Texans who will have a total of $3.1 billion forgiven.

Texas has the highest number of borrowers benefiting from the debt cancellation of any state, according to the U.S. Department of Education. So, what is this new program? Betsy Mayotte, president of the Institute of Student Loan Advisors, joined the Standard to explain.

This transcript has been lightly edited for clarity:

Texas Standard: Tell us a little bit about what makes this new income-driven student loan repayment plan work. Who qualifies, first of all?

Betsy Mayotte: Most federal student loan borrowers are going to qualify for this plan. The only exception are people with Parent PLUS loans. Those borrowers, for the most part, will not qualify for it, but just about everybody else will.

How does it differ from previous federal student loan repayment plans?

There’s a couple of differences between this one and the other existing income-driven plans. The biggest positive change with this particular plan is that if your calculated payment ends up to be less than the amount of interest that accrues every month, that remaining interest will be forgiven.

What we were seeing with the other income-driven plans is that, yes, it created an affordable payment for borrowers, but a lot of times if the payment didn’t cover the interest, they were watching their balance grow. That’s not going to happen under this particular plan.

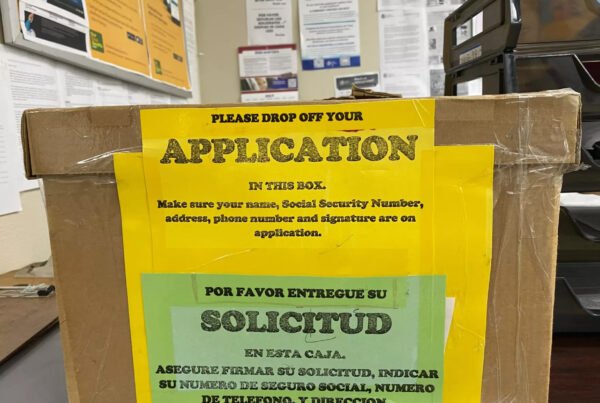

Does this mean that if you already have a loan that’s outstanding, you apply for the SAVE Plan to cover the loan that you already have? Or is this for any future loans that you may take out for education?

That’s a great question. This applies to most federal student loans. It doesn’t matter when you took the loan out. If you have a federal direct loan from 1994, that’s just as eligible as one that was taken out in 2023.

How much is this going to cost the federal government compared to the previously proposed student loan forgiveness program?

They’ve done some projections as to the cost. One of the things I’ve learned in the 25 years I’ve been working in student loans is those projections usually end up changing over time. They’ve done some offsets in other places, but we’ll have to see how much this will end up costing the government.

It seems like we’re having a lot of conversations about what can be done to forgive student loan debt. There’s also been a lot of resistance, coming from a lot of folks who have worked hard to pay back their student loans completely.

There’s a question about whether or not people can take or should be encouraged to take out some of these loans. Where’s that conversation about what makes sense to take out – and as a policy matter, whether or not we want to be forgiving student loans writ large? What would you say to those folks?

You know, it’s certainly a controversial topic. I appreciate the fact that the Biden administration has worked hard to try to provide some relief to the most vulnerable student loan borrowers: the ones whose income is low, or maybe they’re disabled, or maybe they were defrauded by their school. But we really need to make the conversation about the actual problem. And the problem is the cost of higher education. That’s what we need to address to really permanently ameliorate the student debt issue.

Do you hear folks talking about that, or not so much?

Not as much as I would like. In fact, one thing that has bothered me with all the progress we’ve made the past couple of years is that we haven’t had a more robust conversation about that aspect of it.