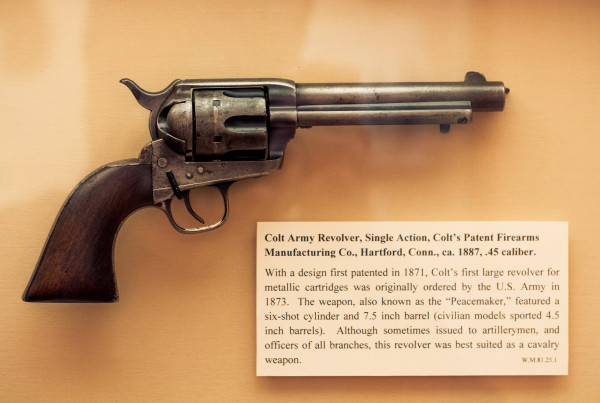

There are fewer active oil rigs right now than there were at any time since 2010. Oil production has been down 27 weeks in a row and there have been over 150,000 layoffs since the production downturn began. What’s going on?

Texas is used to this stuff: the boom and bust of oil. As usual, industry insiders and oil producers keep saying another boom is around the corner. But there could be something more profound happening in the oil industry.

Jesse Thompson is a business economist for the Federal Reserve Bank of Dallas. He says oil and gas might be reaching a new equilibrium here in Texas.

“There’s an argument to be made that with what’s happening on the cost side – and certainly with where people’s price outlooks are going – that when we get to the other side of this particular downturn we’re not going to be going back to the near 2,000 rigs that we saw last summer,” Thompson says.

A big part of the Texas narrative is that the state has done okay through tough economic times because of the oil industry. The last decade of booming oil production has had ripple effects throughout the state’s economy. It even helped to expand the hotel industry in Texas.

So what happened?

Thompson thinks the Organization of Petroleum Exporting Countries, or OPEC, is partly to blame for the recent downturn in prices and oil industry jobs. “With OPEC’s decision last fall not to cut production, it became abundantly apparent that we were oversupplied, prices came down, and drilling came down with it,” Thompson says. And the lower prices and improved efficiency have hurt the Texas economy some.

“The extent to which Texas has outperformed the nation has always been fairly well-correlated with oil prices and rig counts,” Thompson says.

Can Texans count on the oil industry to keep fueling our state’s future? Thompson thinks so.

“Oil is going to continue to fuel the Texas economy in a big way,” Thompson says. Much of his optimism about the future comes from what he sees as an industry-wide focus on efficiency.

“Aside from just the cuts in drilling, aside from just the decrease in price of oil, our costs are falling,” he says. “We’re continuously improving efficiency, we’re continuously getting better at pulling more of this stuff up out of the ground at a lower cost.”

As the oil industry continues to innovate and get more efficient, that could mean lower prices for consumers but fewer jobs for Texans. “As [innovation] continues to happen, what that means is that in order to produce at high levels in the future, it’s not going to require as high of a price of oil, it’s not going to require as many rigs, and it’s not going to require as many personnel,” he says.

But the boom and bust cycles of oil production aren’t a thing of the past yet. “I don’t think they’re necessarily behind us,” Thompson says. “This is a relatively novel revolution, the shale revolution.”

So will a more efficient oil industry ultimately hurt the Texas economy? Maybe.

“There’s just a lot that we don’t yet know about what the economics of this industry are gonna look like going forward,” Thompson says. But he says one thing’s for sure.

“We’re gonna have to really start rethinking our paradigm here for how the oil industry impacts the Texas economy in the longer term,” Thompson says.