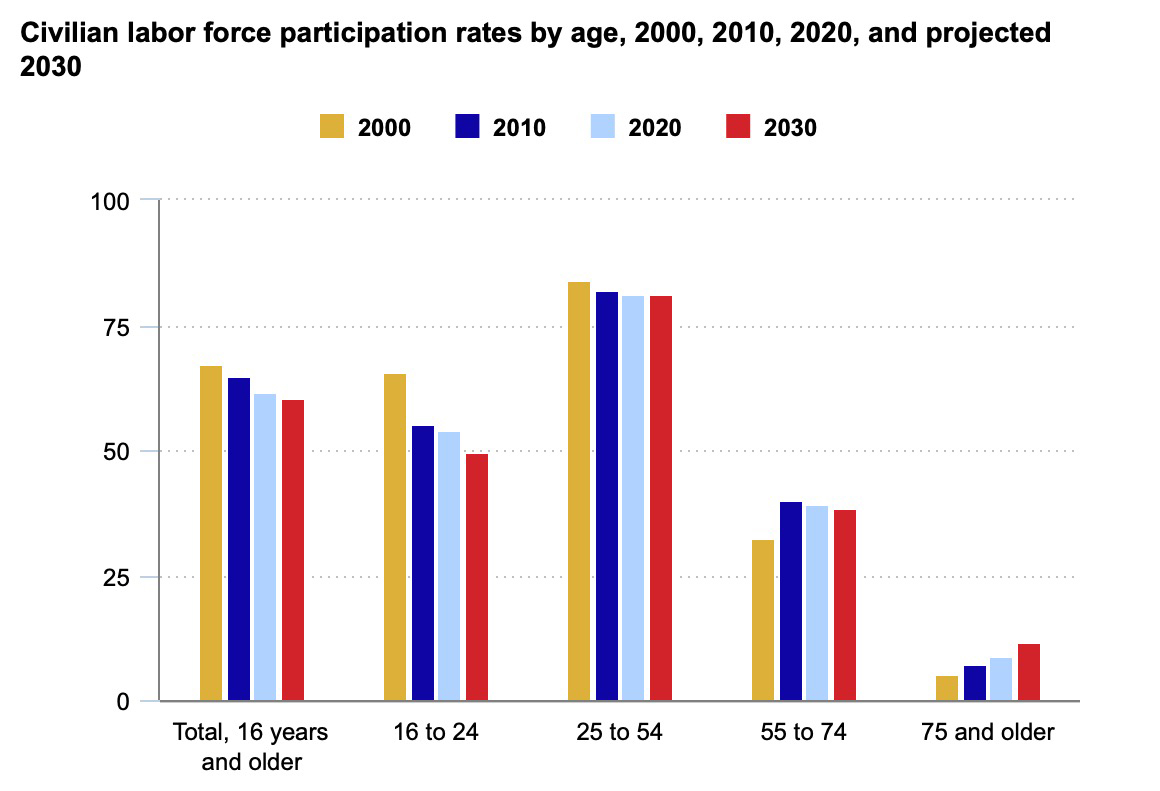

Over the next decade, the percentage of people in the United States who work is going to shrink.

That’s according to recent data from the U.S. Bureau of Labor Statistics. Across every age group, there will be fewer people working or looking for work, with one exception: The number of people age 75 and older is expected to double by 2030.

Nancy Morrow-Howell, director of the Harvey A. Friedman Center for Aging at Washington University in St. Louis, spoke to Texas Standard about the influx of older workers into the job market.

This transcript has been edited lightly for clarity:

Texas Standard: What are the main factors that seem to be driving more people in retirement age back to work?

Nancy Morrow-Howell: Well, we’re all living longer. So, those stats that you gave about changes in the workforce overall are because we’re living longer and we’re having fewer kids. People are working longer for two reasons, for two different explanations: They have to because we live a long time in retirement and we don’t have the savings to do that, or we want to because we find our work meaningful and an important part of our daily lives.

It seems like the money factor, especially right now, seems to be driving a good deal of the returns we’re seeing to the workforce by people who are previously retired. Bloomberg had a recent story on people who decided to retire as planned, but then found out about what’s been happening with the economy and inflation. Also, the fact that there are openings has made the market a somewhat riper place than it once was for that.

Yeah, I think that’s true. I think those same two reasons bring people back: because they need to and because they want to. It’s nice if those two things combine, because way too often people need to work longer or come back to the workforce purely out of economic need, and they take jobs that aren’t necessarily that personally meaningful or fulfilling to them. So, it’s nice when we have folks who can have both of their needs met in the job market.

But of course, the reality of it is a lot of workers have been looking forward to retirement. I’m curious how returning to the workforce can affect people’s quality of life.

Yeah, it’s certainly not good for everybody and for folks who just can’t do it because of their retirement savings. A lot of the burden is on employing organizations to be more inclusive of people of all ages. So, we say, ‘Oh, people want more flexibility.’ Well, workers of every age want more flexibility. It’s not just older workers. So, a lot about it is making workplaces better for workers of all ages, including older workers.

What kinds of jobs are older workers taking? Are you seeing any patterns yet?

Well, interesting question. With the pandemic, we know that older people were kind of the first out because of concerns about health or downsizing and being concerned about vulnerability. And they’re going to be the last back in because that happens with age. Discrimination is the strongest when people are trying to enter a job market. What kind of jobs are they taking? I don’t know if I know the answer to that, particularly, if we know enough about people coming back to the job market. Mostly what I’ve been reading is it’s harder for older workers to get back in.

I’m sure the data is still sorting itself out because this is a relatively new phenomenon. Which brings me to the question of whether you see this as a demographic fluke – I’m curious as to whether we’re looking at a long-term trend or something much shorter?

My guess is that it’s a long-term trend. The demographics are pretty well set in stone to carry us out as far as we can see, with birth rates and life expectancy. And we are living into our late 70s, early 80s. Retirement income remains just an unsolved problem in this country. Social security, I think, is going to be there, but it doesn’t cover enough. So, we have to figure out how to get people to be in jobs where they can save and employ. The distribution plans have changed so much that we have to figure out how to help people participate in retirement savings plans, whether they’re working in organizations that offer them or not. So, I think it’s here to stay and we want to have solutions to figuring out how you have income security for a longer life course.