The lithium-ion battery is one of the inventions that makes the modern world possible. It’s in your cell phone, your laptop, maybe even your car. The device’s essential element – lithium – is therefore in very high demand.

Right now most of the world’s lithium production occurs in Australia and Chile. But some lithium miners have tabbed East Texas as one of the element’s potential hot spots.

Samuel Shaw, reporter for the Longview News-Journal, spoke to Texas Standard about the region’s lithium rush. Listen to the interview above or read the transcript below.

This transcript has been edited lightly for clarity:

Texas Standard: You recently took a close look at the emerging lithium industry in East Texas. Let me first just ask “why?” Why is this part of the state getting attention as a place to potentially mine lithium?

Samuel Shaw: It is getting attention because some of the highest grades of lithium, or I should say the highest grade of lithium sampled anywhere in North America was in deep East Texas, just by the Louisiana border. And then another sample was taken, which was even higher, just a bit west of that in Franklin County, in a formation called the Smackover.

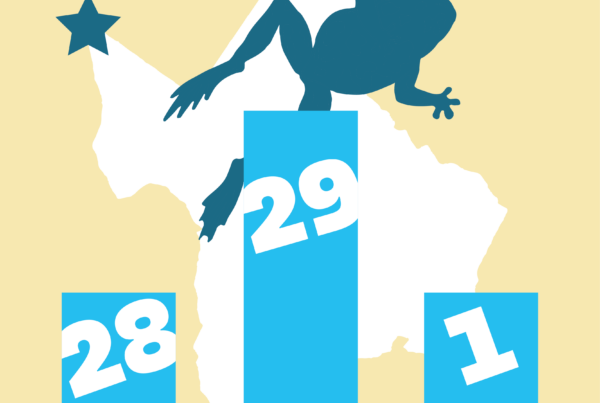

The United States produces just 1% of global lithium. Most of that comes at the moment from Australia, the lithium triangle and, South America and China.

Are we talking about a lot of companies flooding into the area? Is there really just one? What’s the market look like at the moment?

At the moment, we know that there is Standard Lithium, which is a Canadian company. There’s East Texas Natural Resources.

Through contracts which were filed with the railroad commission, which is overseeing brine mining, we have seen some other companies jump in there, like Black Mountain Lithium. But right now this is all very fresh and novel and new and Standard Lithium was sort of the first entrant into the market here.

Well, how long’s it been going on? How long has Standard Lithium been operating in the area?

I think they began looking at geologic data and seismic information about five years ago. Obviously, East Texas is where the Texas oil boom began. So there’s a lot of information that’s available. The geology is well understood. And they knew that there was lithium here.

Then they began, around three years ago, very quietly locking down mineral leases. They became more and more confident that these deposits were not only here, but they were an extraordinary grade.

A executive at the company told me during an interview that they didn’t say much about what they were doing here because they knew what they had, and they didn’t want to face competition from a large company like Exxon, which has also started to move into renewable energy and increasingly into lithium in southwest Arkansas.

So when we’re talking about mining lithium, what is the operation actually like? Is it like a pit? Is it more like fracking? What’s the operation look like?

Well, it is like a pit and strip mine in a lot of parts of the world. That’s not what these companies are looking at. They’re looking at a technology called direct lithium extraction, which does resemble fracking in a lot of ways. In fact, the method is borrowed from a fracking technique.

And so what it looks like is a well being drilled, and then they run this salt water brine from about two miles underground into a processing station, and then from there, refine that brine into a battery grade product.

Normally it takes about a year and a half to two, conventionally, to get battery grade lithium. But they’re trying to cut out that conventional component entirely and basically do this as one kind of closed loop.

Does that make for a potentially cleaner process? I’m sure there are people who are concerned about environmental issues.

Yeah, I mean, even according to environmentalists, this is far and away the best way to get lithium if you have to get it, and it looks like we should.

But having said that, it does come with some consequences. Like the brine contains a lot of salt – packs more salt that seawater does. And salt is extremely damaging to ecosystems.

As far as the footprint goes for these drilling sites, they’re really small. They don’t look like a pit mine or anything like that. And I think that’s part of the reason why local policymakers, politicians, have sort of welcomed the industry in here.

Well, it’s definitely new, this whole concept, to Texas at least. Do you get the sense – talking about some of those public officials, regulators or attorneys looking at contracts – do people know what’s going on out there? Do people have a sense of how this all works or are they flying blind?

So I think that, at a county level, in places that first came into contact with these companies – like Cass County, Franklin County – folks who were making decisions have a decent idea of what’s going on.

But what really matters is that the folks on the ground, the landowners who are being approached by land men for contracts inquiring about their brine, they tend to not know as much. And that kind of gap in information is where there have been some difficulties.

There have been allegations of perhaps predatory business practices linked to one company. But a lot of this also has to do with the fact that the legal terrain itself is pretty nebulous at the moment. Unlike oil and gas, there isn’t a century worth of case law. And so a lot of this is in the process of being regulated, and policies are being designed at the moment.

Can you describe the range of opinions you’ve heard from locals about how they feel about this potential development moving forward?

Well, first, I mean, people are used to extractive industries out here. So, the idea of somebody offering you a deal to drill on on your property is not something new or necessarily unfamiliar.

What has concerned some locals is just that gap of information, which I alluded to before. Folks thinking that a strip mine might be going in their backyard or something like that. But the money talks and this is an area where oil and gas production has plummeted pretty much across the board.

And so folks are also interested in getting a little bit financial security, perhaps through these contracts. Though the money isn’t quite what it is with with oil and gas.