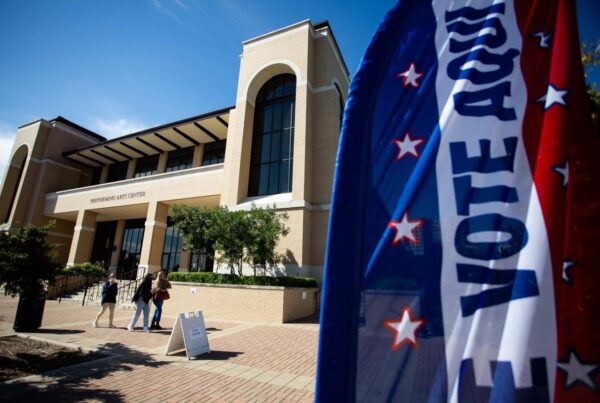

Some 3.65 million Texans have student loan debt — the second highest number of student borrowers in the country, holding about $120 billion worth of loans.

At present, those holding student loans aren’t paying, but that could soon change depending on the outcome of a Supreme Court case.

President Biden’s plan for debt forgiveness is being challenged in the highest court in the land and payments are on hold for all 45 million people with student loan debt across the country. The average borrower has about $38,000 in loans. If the Biden plan is upheld by the court, about 20 million people would have their debt completely erased, leaving 25 million people with payments to make.

The government says those payments will resume either 60 days after the Supreme Court issued its decision or 60 days after June 30, whichever comes first. That means repayments would begin likely in the summer or fall.

The Supreme Court heard arguments in two related cases challenging the debt forgiveness plan Tuesday. The cases are being brought by several Republican-led states and a conservative group.

Seth Chandler, a professor at the University of Houston Law Center, said the question at hand in both cases is whether or not the Secretary of Education has the authority to wipe away student loan debt in the first place.

“People can disagree on whether that student debt should be wiped out in light of the pandemic,” he said. “But the issue before the court wasn’t whether it was a good idea. The issue before the court was whether the president, the executive branch, should be able to decide that on their own or whether they had to go back to Congress for more explicit authority.”

During Tuesday’s arguments, the solicitor general for the U.S. gave an interpretation of the law that would allow the Biden plan to go forward.

“The solicitor general read the statute to the court, which said that the secretary during a national emergency could waive or modify the regulations of the loan,” Chandler said. “She said that one way of modifying or waiving it was simply to cancel it, and therefore you didn’t need any fancy interpretation. She felt, as did some of the justices, that interpretation of the statute was straightforward.”

Several of the conservative justices seemed skeptical of that argument, Chandler said.

“Chief Justice John Roberts, I think, really tipped his hand and said that he felt that this was way beyond the scope of anything that Congress had anticipated and wasn’t encompassed within the term ‘wave or modify,’” he said.

There is also a legal issue at play here, Chandler said, related to whether or not this case is legitimate to bring before the court at all. This is called “standing.”

“If the court finds that none of the plaintiffs in either of the two cases have standing, then the Biden administration plan can go forward until somebody somehow finds a better plaintiff,” he said. “And that means, I think, for the foreseeable future, the Biden plan will be in effect.”

Chandler said his guess is that one of the two cases will not go through, but the second has a better chance.

“The claim of a Missouri state enterprise called MOHELA (the Missouri Higher Education Loan Authority), that they have standing because they will lose revenue, because they won’t be servicing loans, that is likely to succeed with a majority of the justices,” he said. “And as I mentioned, it just takes one to have standing before the Supreme Court hears the merits. And once it hears the merits, I’m afraid the Biden plan is doomed.”

Chandler said he expects this case not to be decided before the end of the court’s session in June.

“We’re already in March. They’ve got a lot of other big cases before them. I would be surprised to see a decision in this case before mid-June,” he said.